By Bill Kemp

I had the privilege to present a major paper and moderate two other panels at the World Gas Conference in South Korea in May 2022. The International Gas Union hosts this triennial gathering of all the major gas players around the world, across the value chain (except for Gazprom of Russia, which was disinvited due to the Ukraine war).

Following are three blogs that I posted, one for each day of the conference. Below the blogs is a link to my presentation, which focused on net-zero pathways forward for the gas industry.

Rebalancing the three gas value pillars

The 7000+ attendees of the #World Gas Conference 2022 were all happy to renew old acquaintances face-to-face (or at least mask-to-mask) in Daegu, South Korea. The massive convention center is filled with equally massive exhibits, mainly by the major upstream suppliers, LNG producers, and LNG customers. It’s a high stakes mating game around new long-term supply contracts, with an urgent mission to fill the gaping hole from sanctioned Russian gas.

Much of the discussion in the hallways and executive panels touched on the three pillars of the natural gas value proposition: #sustainability, affordability and stability. In the wake of the natural gas market upheaval and unprecedented spot LNG prices (“uncharted waters”), especially in Europe, the industry perceives a need to focus now on mitigating prices and assuring supply. There was no retreat, however, from meeting long-term decarbonization goals.

The current crisis state is clearly not sustainable. The shift back to coal for power generation in regions with limited or very high-priced gas supply has been an environmental tragedy, reversing years of progress in reducing power sector GHG emissions. Let’s hope the industry and its stakeholders can collaborate to find more robust long-term solutions. The CEO of Korea Gas Company, one of the largest LNG importers, quoted Churchill: “Don’t let a good crisis go to waste.”

What is really driving natural gas prices?

You may not feel it so much in North America (except some minor pain at the gasoline pump), but the global energy market is creaking under great strain. Spot market prices for LNG, perhaps the best indicator of the current gas supply-demand balance, have spiked to five times their recent historical range, and are staying there. The session on the trajectory of global gas prices at the World Gas Conference was packed. Lots of worried buyers.

It’s not just the reduced flow of Russian gas. Other major drivers include the rapid post-covid recovery of energy demands, US gas producers’ reticence to invest in new production due to their punishment in the recent gas market bust, labor shortages in the production basins, and supply chain issues (pipes, pumps, etc.). All these factors have slowed the supply response to higher prices.

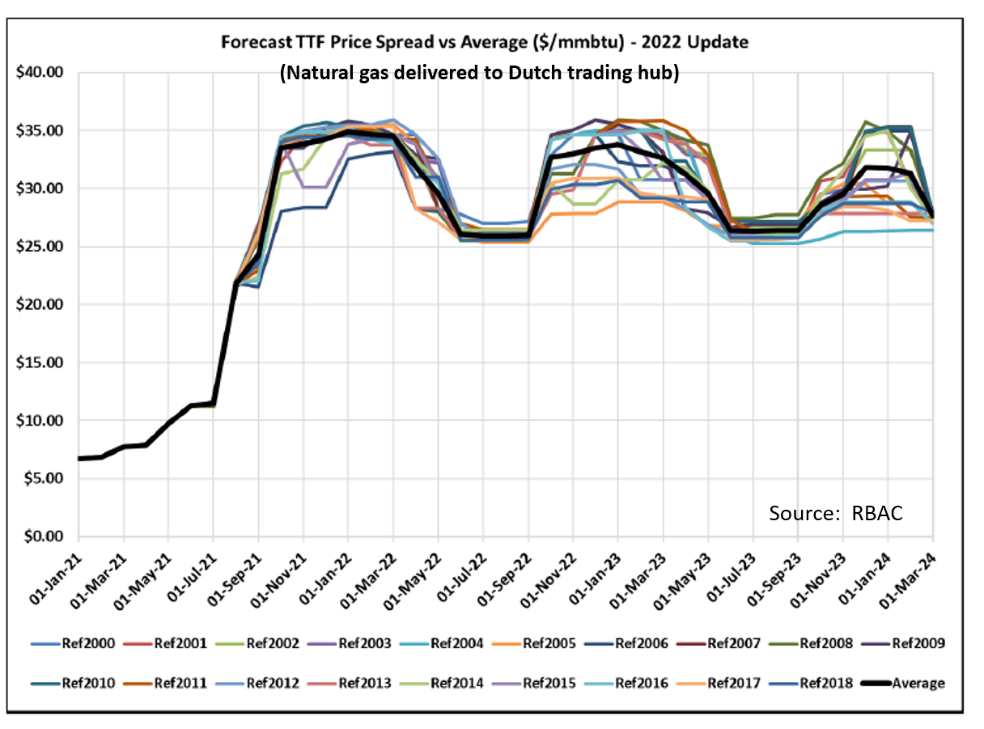

The smart energy market modelers are pointing to continued very high natural gas prices. RBAC, a Houston-based gas market modelling firm, applied their expertise to those near-term global market dynamics. They concluded that the supply-demand imbalance will result in peak season spot prices in Europe through 2024 that are roughly similar to recent experience. I.e., much higher than pre-2022. The graph at right of their forecasted prices at the Dutch natural gas trading hub shows that the trend in global spot LNG prices declines only slightly through 2024 – a conclusion that holds up across many modeled scenarios.[1]

Stronger LNG export demands will exert upward pressure on domestic gas prices in producing countries, too – most prominently the U.S. Bob Brooks of RBAC commented that the recent sharp upward move in US spot prices may be an early sign of closer linkage to LNG prices. More like the way domestic and global prices for oil are set, in other words.

Gas and LNG producers at the World Gas Conference in Korea certainly are flush with cash and strutting their stuff. However, they are worried about destruction of long-term demand if consumers decide very high natural gas prices are unacceptable and accelerate their move to other energy sources, most prominently renewable electricity and hydrogen. This is how the gas market may well play out in post-covid, post-Ukraine war future.

What is the global role of natural gas in the energy transition?

The attitude of World Gas Conference participants from developing nations was noticeably focused more on expanding access to natural gas, rather than restricting it as has been the recent trend in Western Europe and North America. They view natural gas and LPG (made from natural gas liquids) as relatively clean fuels that could displace dirtier coal, oil, kerosene and even wood.

The president of the natural gas industry association in Columbia was passionate about the health and environmental benefits of gas. Access to gas has increased in the past two decades from one sixth to one half of the population, reducing both economic and energy poverty. Popular support for initial steps toward energy system decarbonization has been built on the theme of “the energy transition is about people” – tangible benefits to quality of life. The Environmental Defense Fund’s leader for energy transition issues agreed that cleaner energy solutions must address energy equity and access. 2 billion people do not have clean cooking fuel. He acknowledged that natural gas can indeed improve air quality, while insisting that methane leakage reductions must be an essential early GHG abatement step across the global value chain for natural gas.

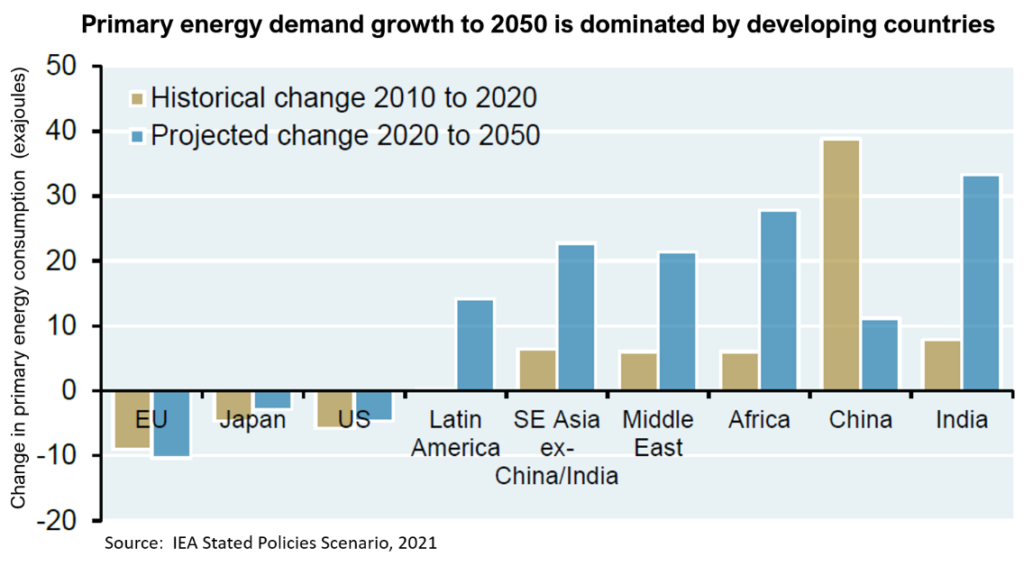

The thirst for more energy to fuel economic growth will make developing countries the biggest drivers of increased energy demands in the 2030s and 2040s. As the graphic at right below shows, that growth will more than offset modest declines in energy consumption industrialized nations. LNG cargoes will no doubt start shifting to those new customers as we get into the 2030s.

If climate stability goals for 2050 are to be achieved, these diverse international trends must converge – sooner rather than later – on very substantial reductions everywhere in unabated fossil fuel consumption. Successful energy transition solutions should be not only sustainable, affordable and secure, but also transferable and massively scalable. The mountain is high, yet it must be scaled. Those were some of the final insights offered at the 2022 World Gas Conference.

[1] Post-note from March 2023: Gas prices did stay stubbornly high until early March 2023, when the combination of surging US LNG exports to Europe and lower gas demands due to warm winters in US and Europe plus price-induced conservation finally started moving US and international gas prices back toward pre-Ukraine war levels.